Netflix's Worst Nightmare

It's NOT Apple, Disney, Amazon, or Hulu...

Instead, it's a smaller American company

whose stock is set to DOUBLE every 2 ½ years.

From the Desk of Stephen McBride, Chief Analyst at RiskHedge

Fellow investor,

Remember when there were only a few channels on television?

We watched shows like Cheers, Seinfeld, and Everybody Loves Raymond.

Those days, families often watched together.

Thursday nights were TV nights. 8 p.m. was Prime Time.

Back then the kids would complain “There's nothing to watch!”

Ever notice kids don't say that anymore?

That's because Netflix alone has over 4,579 movies and 1,081 television shows.

And it’s not just the kids. Two in three Baby Boomers subscribe to Netflix.

Now mom, dad, and the kids all watch different Netflix shows right in the same room on their own tiny screens.

People love their Netflix!

Maybe that's why I hit a sore spot last December...

That's when I publicly predicted that, as an investment, Netflix's best days are behind it.

Over 2.5 million people stopped by Forbes to read my prediction.

That's more people than in all of New Mexico.

Sure enough, Netflix's stock tanked 42% after I warned folks not to buy it.

But I'm NOT writing you today to warn you about Netflix.

Instead, I’m writing to tell you about a little-known company that has Netflix by the throat.

Not 1 in 100 investors know about this stock. So, there’s a short window of opportunity to get in early.

But that window won’t stay open long.

You see, this company controls a precious resource that is the lifeblood of Netflix’s business.

It's hard to believe, but without this resource, Netflix is dead in the water.

I’ll show you exactly what this resource is in a moment.

And I’ll show you how the stock of the company that controls this resource is set to double, or better, every 2.5 years for the foreseeable future.

I call this company Netflix's worst nightmare.

Because with the flick of a “switch,” it could soon be the reason that...

Netflix Goes Dark

It all comes down to bandwidth.

Bandwidth is a fancy name for the peak amount of data that can flow across a computer network.

source: www.sandvine.com

If your computer slows down when you’re online, chances are you’re short on bandwidth.

Well, according to Fortune magazine, Netflix is by far America’s biggest bandwidth hog.

Netflix users consume 19.1% of all bandwidth in America!

Just like your computer goes down when bandwidth runs out, Netflix can go down too.

In fact, according to USA Today, recently Netflix went dark across the world for more than two hours.

You might think, “So what, it's just two hours. Cable used to go down all the time.”

And you'd be right.

But demand for bandwidth is set to quadruple within five years.

So outages will get a lot worse.

That’s why smart investors are asking a key question:

Where do you get more bandwidth?

Well, Netflix needs two things to function:

- Data centers to store all its movies and shows

- And “switches” to route those shows and movies to where they’re supposed to go (like to your TV)

Turns out, Netflix owns neither!

In 2016, it sold off its data centers and partnered with Amazon instead.

Yes, Amazon.

The same company that sells books, toilet paper, and diapers also leases its data centers to companies like Netflix.

In fact, most people don't know this…

But about 85% of Amazon's profits come from selling data center services to companies like Netflix.

Amazon owns room after room filled with rows of giant data centers just like this one...

Amazon's secret profit centers

So, when you point your remote to watch a show on Netflix, it's actually Amazon that pushes the show to your television.

Now, remember I said Netflix needs two things to keep up with bandwidth requirements?

One is data centers to store the content. I just explained how Amazon actually controls those.

The other thing Netflix needs are networking switches.

Networking switches are a lot like railroad switches.

But instead of routing trains, network switches route data.

They send the right shows and movies to your TV.

Well, Amazon doesn’t make switches.

It has to buy them from the “Netflix’s worst nightmare” company I’ve been telling you about.

That's why, if you're an investor hunting for big, safe profits, it's this switch company you should pay close attention to.

It’s crucial to the growth of companies like Netflix and Amazon.

Which is exactly why, according to my research, this switch company is set to double every 2.5 years for the foreseeable future.

That’s like turning every $1,000 to $16,000 over the next 10 years.

Why am I so adamant about the growth of this switch company?

Well, I’ve already shown you how Netflix and Amazon are completely dependent on it.

But it’s not just Netflix and Amazon...

Google and Microsoft also need this company’s switches to keep growing.

Keep in mind, Microsoft, Amazon, and Google are 3 of the 4 richest companies on earth.

But as big as they are, these three giants only account for about 40% of this company's revenue.

5,000 other customers buy their switches too.

Including the Pentagon, which recently placed a $100-million switch order.

So, none of what I'm showing you is hypothetical.

This company is already selling billions of dollars of these switches.

That's because...

This ‘Switch' Company Owns a

Toll Booth Position in the Marketplace

The company I'm talking about has a key competitive advantage.

It has a toll booth position.

What do I mean by a toll booth position?

Let's say you're in Washington, DC. And you want to take the family over to Chesapeake Bay for some great Virginia oysters.

You have a couple choices. You can head up I-95 North and spend 2.5 hours fighting traffic.

Or, you can drive across the Chesapeake Bay Bridge in 1 hour and 20 minutes instead.

That will save you at least an hour each way. And a lot of frustration.

But for that privilege, you have to stop at the toll booth and pay $6.

That's not a bad tradeoff. 60,000 people choose to pay that toll every day.

Some companies find themselves in toll booth positions too.

Take Netflix. Back in its heyday it took the entertainment world by storm.

Writers and producers scrambled to get their shows on Netflix—not on ABC, CBS, or even NBC.

If they wanted their shows to reach the viewing public, they pretty much had to go through Netflix.

In other words, Netflix owned the toll booth.

Which is what made early Netflix investors rich:

With stocks like Netflix, and this switch company I've been talking about, you don't even have to get in at the start to get rich.

If you'd invested in Netflix just 4 years ago, you'd still have grown your money by almost 5 times.

Unfortunately for Netflix, it doesn't hold the tollbooth position anymore.

That's because there's now more competition in the video streaming space.

Amazon owns a streaming service that's growing in popularity.

Apple is launching one.

Even Disney is starting its own service called Disney+.

In fact, Disney will be pulling their movies off of Netflix sometime this year or next.

Fortunately, the switch company I've been talking about is light years ahead of any competition. Its toll booth position is secure for at least 5 more years, through 2024.

Another toll booth company is Microsoft (MSFT).

You hear a lot more about Apple (AAPL) these days...

But did you know that Microsoft is just as big?

It’s true. And despite all the hype around Apple gadgets, Microsoft still owns 75% of the personal computer market.

You see, for a long time Microsoft had a toll booth position. In fact, it still does.

Computer manufacturers like Dell had to run Microsoft Windows on their machines, or nobody would buy them.

That's what allowed Microsoft investors to almost 7X their money over the last 10 years…

Even though you don't hear about Microsoft in the news much anymore, its toll booth position is so powerful it cemented them as the richest company in the world.

That's why I invest in toll booth stocks.

As you'll see in a moment, the network switch company I've been talking about has a toll booth position too.

Which is why it looks like an early Microsoft or an early Amazon.

Their magic is in those switches I mentioned earlier.

You see, there's a reason Amazon, Google, Microsoft, the Pentagon, and others need this company's switches, and nobody else's. Even though they cost more.

It's because this company has a special competitive advantage that I'll share with you in a moment.

For now, I trust you see why investing in toll booth stocks sets you up to earn big, safe profits.

But toll booth investments are even more lucrative when you combine them with...

The Most Powerful Investing Force

in the Universe

“The business models of 35% of S&P companies are under active attack. Disruption of these companies and their business models is happening at a faster pace than we’ve ever seen. This is one of the biggest risks (and opportunities) facing investors today…”

- Jim Furey of Furey Research Partners

As I've shown you, toll booth stocks are great if you're looking to beat the market.

But if you're looking to obliterate the market…

To more than make up for the crashes in 2000 and 2008/2009…

To bolster your nest egg so you can escape the rat race and enjoy retirement...

Then you should know there's an even more powerful investing force.

It's so powerful I've devoted my entire career to it.

Which is why I'm writing you today.

As you probably know, my name is Stephen McBride.

I'm originally from Ireland. But you may recognize me from popular American financial television.

Here I am speaking with Yahoo! Finance.

That's me on the right:

I've always been intensely interested in the markets.

I worked at a billion-dollar financial institution in New Zealand. And I pretty much hated every minute of it.

Corporate life is just not for me. So I quit the rat race.

Today, I come and go as I please. I split my time between the US and Ireland.

Thanks to the internet, I don't need to work for some big Wall Street conglomerate that makes millionaires and billionaires richer.

Instead I help individual investors build lasting wealth.

Stephen presenting at Columbia University

Here I am presenting to an audience of thousands at Columbia University in New York City.

I'm beholden to no one. I'm an independent analyst.

Which means all I care about is doing great investment research and passing that research along to my readers.

Speaking of readers, I mentioned earlier that my research is regularly featured in Forbes. And that 2.5 million people read my work there.

Another 30,000+ independent-minded investors read my free research reports every week.

People like Victor V., who said...

“Your picks such as TTD, MCHP, and QCOM, to name a few, have all given me amazing returns.”

And Ron A., who said...

“Stephen - nice call on Disney stock. Made me some $$$ because I listened to you. Thanks!”

And Lelex A., who said...

“Your weekly emails are pure gold!”

And Carson R., who told me...

“I've been a subscriber for a few months now and I wanted to say thank you! I appreciate you putting your money where your mouth is.”

Or the semi-retired, 62-year-old life insurance agent,‘Pablito’, who said...

“I find the research fascinating and believe it to be the only way to invest going forward.“

Or even Bill M. who simply said...

“I've already made money on your most recent recommendations.”

Nice comments like these keep me researching and sharing.

And research is pretty much all I do.

That's how I discovered this toll booth switch company I've been telling you about—the one my research shows will double every 2.5 years for the foreseeable future.

That's like earning roughly 31.5% every single year.

In the entire 10-year bull run we're in now, there's only one year the S&P outperformed that!

In fact, over the full bull run, the S&P only returned an average of 13.45% per year.

Keep in mind, that's during the greatest bull run in American history.

The truth, as you'll see more proof of in a moment, is there's one type of investment that trumps all others.

Especially if you're not into options or anything complex like that.

Stephen McBride as seen on the American Disruption Summit

Before I tell you the one type of investing strategy that trumps all others, I need to explain to you...

Why Some Investors Get Left Behind

I know a lot of investors who've felt that way over the years.

They missed the massive profits available in stocks like Google, Apple, and Facebook.

In fact, as you'll see in a moment, plenty of other stocks produced even bigger profits than those.

Most investors missed those life-changing returns too.

For the most part, people missed out on those profits because they didn't understand the companies.

Years ago, who could tell how much Google, Facebook, and Netflix would change our daily lives?

You see, these companies share a common thread.

And that's disruption.

Some companies come along and upset—or disrupt—entire industries.

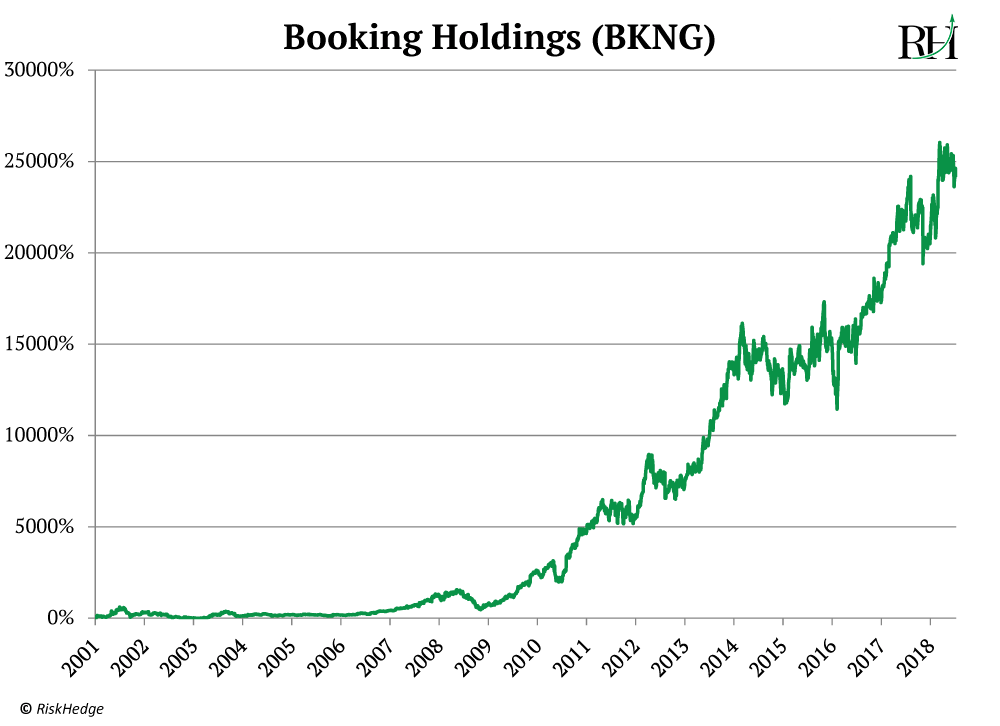

Take Priceline.com (BKNG). Priceline was first to disrupt the travel industry by offering online travel booking.

Before Priceline, everyone used travel agents. Now, just about everyone books online.

The travel agent is on the endangered species list.

As I've been saying, disruption is a powerful force.

That's why early Priceline investors collected gains of 27,557%.

Which is like earning 40.14% every year for more than 17 years.

An early investment in Priceline of just $1,000 would be worth $275,569 dollars today.

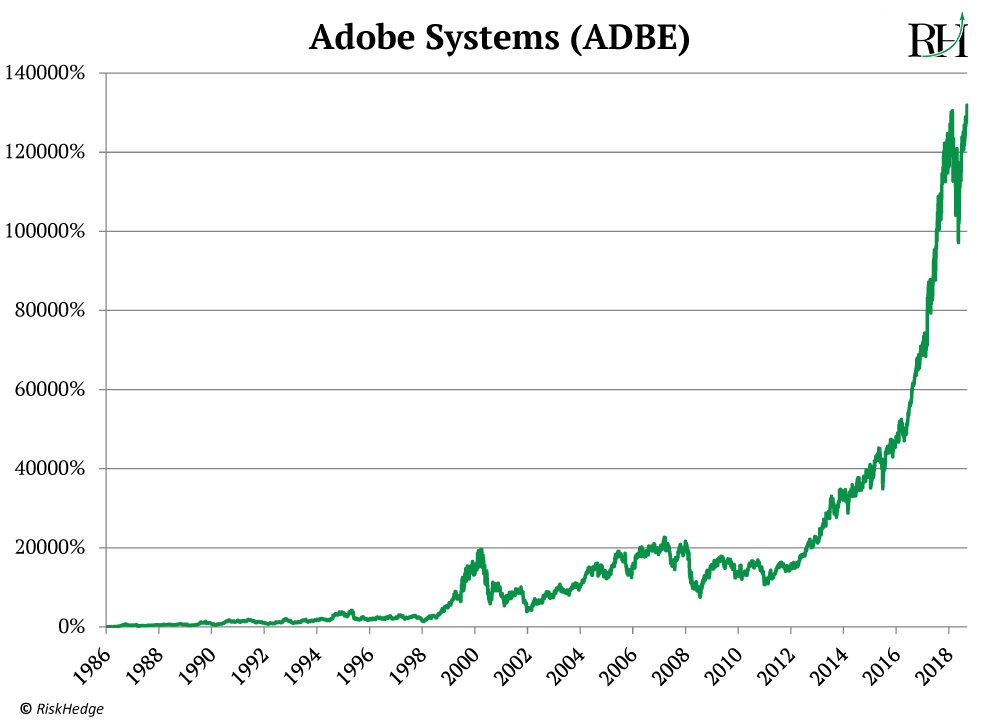

And then there's Adobe Inc. (ADBE).

Adobe disrupted the document industry.

It made it easy to share documents across different computers.

Investors who got in early with this disruptor would earn an annualized 48.39% a year, every year, for the next 14 years.

That's almost like doubling your money every 2 years, 7 times in a row.

And even if you'd held on to Adobe through the dot-com meltdown, you'd still have earned 25.14% every year for 32 years!

That means you would have doubled your money 9 times.

That's the power of disruptor stocks like Adobe.

Why I'm Predicting a Similar Return for This Network Switch Disruptor

I showed you how Adobe would have doubled your money every 4 years.

I expect this network switch disruptor to do twice as well as that.

It should double your money every 2–2.5 years.

Before I show you my research that proves this, let me show you one other disruptor.

And that's Cisco Systems (CSCO) …

In just over 10 years, Cisco returned 99,225%.

That would’ve doubled your money every single year!

And every $1,000 invested in 1990 would have been worth $993,250 just 10 years later.

But it's how Cisco made its money that's important to you today.

Cisco makes networking equipment.

It made the equipment that allowed computers to connect via networks.

And one of the key pieces of equipment Cisco sold was networking switches…

Just like the other company I've been telling you about.

That's what took Cisco from nothing to a market cap of over $550 billion, making it the biggest company in the world in the year 2000.

Here's what a switch looks like

They achieved this by selling networking switches.

But here's the key that most investors haven't realized yet:

Cisco's networking switches have fallen out of favor.

And companies like Amazon, Google, and Microsoft are replacing them with this company's switches instead.

In other words, this company could go on the same kind of tear that Cisco did 20 years ago, selling a similar but superior product.

Now, I'm not telling you this new networking switch maker will grow as much as Cisco did in the ‘90s.

For one, Cisco was an 8-cent stock at the time. And the company I'm telling you about is no penny stock.

In fact, it's a $24-billion company already.

Still, though, it's eerily similar. So much so that I call this company the next Cisco. For 2 important reasons...

First, Cisco was a disruptor.

It provided switches and other hardware for the biggest disruption up to that point—the rollout of the internet.

This new switch company is a disruptor too.

And as I'm about to show you… it's actually disrupting Cisco!

The second reason for Cisco's success was its toll booth position.

Any company that wanted to get online used Cisco's equipment.

Now, the tables have turned.

This new switch company has taken over the toll booth position in the networking switch market.

Out with the Hardware,

in with the Software

This new switch company is beating Cisco at its own game.

You see, Cisco got to where it is today by selling those data center network switches.

The kind that let Amazon send the proper Netflix movie to your devices.

But Cisco's old switches are now obsolete.

This new company has created a better and much faster switch.

And so they've become the preferred company to buy from.

They disrupted the disruptor!

That's why this pick is such a no-brainer. It's like watching Cisco all over again.

We practically already know what's going to happen.

Why does this company have Amazon, Google, Microsoft, the Pentagon, and 5,000 other companies clamoring to do business with it—and NOT Cisco?

Because it figured out how to turn a hardware switch into a software switch.

That may sound simple, but it’s actually genius.

The switches that this company makes are much faster and easier to use than Cisco's.

Which means they're a whole lot more cost effective.

Often the old switches supplied by Cisco couldn't be reused. So, they had to be thrown out.

It was great for Cisco, since its customers were trapped into buying new switches all the time.

But it wasn't so great for its customers.

That's why Amazon and the other giant data center companies are scrambling to get rid of old switches.

They're basically switching out Cisco’s switches for newer, better ones as fast as they can.

And they have to buy from the company I've been telling you about.

You might be wondering how big an opportunity this networking switch market is.

Well, today, the network switch market is worth about $4 billion.

Right now, Cisco enjoys almost HALF of that business.

Meanwhile, the company I'm telling you about only has about 16% of the market.

That means it sells $640 million in networking switches per year.

I expect those numbers to flip, though. Fast.

My research shows this company could take Cisco's 49% market share within 4 years.

And it should take market share from smaller competitors too.

Plus, the networking switch space is growing fast.

By 2023, network switches are projected to be a $6.84-billion industry.

If this company grabs another 50% of the market, it would enjoy annual sales of about $5.1 billion in network switches alone.

That means it stands grow sales by 280% over the next four years alone.

And if the share price follows, you'll 2.5X your money in just four years.

(I have other research that shows those returns are conservative. But I want to share the conservative case with you.)

That's why I call this company...

The Next Cisco

Today, I'd like to share how you can get in on this stock.

I want to give you all of my research so you can decide for yourself if it's as great of a disruptor investment as my research suggests.

That's why I want to give you...

This FREE special report called The Next Cisco: Double Your Money Every 2.5 Years as History Repeats Itself.

When it comes to this networking switch maker, history really is repeating itself.

The company is beating Cisco at its own game. They're disrupting the disruptor.

And inside this free report, you'll see all my research that shows why 31.5% gains every year is actually conservative.

I'll send you that report, absolutely free, when you to take me up on a risk-free 30-day test drive of my newest research publication, Disruption Investor.

Disruption Investor is our new flagship research service that's focused 100% on disruptors.

When I say “our,” I'm talking about RiskHedge—the financial research firm that I partner with.

As far as I know, RiskHedge is the only company in the world that's 100% focused on disruption.

The idea behind Disruption Investor is to find disruptive stocks that will change the world. Ones like Priceline, Netflix, Adobe, and Cisco.

Readers of Disruption Investor will never feel left behind by companies they don't quite understand.

That's because my team at RiskHedge and I are 100% focused on finding profitable disruptors and bringing that research directly to you.

That way, you can decide for yourself if you want to follow our lead and invest.

As I said, Disruption Investor is new.

But that doesn't mean it's untested. In a moment, I'm going to show you how a small group of my readers profited from 3 different picks, each of which made double-digit gains in just a few months!

One RiskHedge reader, Ken H. from Iowa, shared the following…

“On 3/8/2019 I reread your article and it made sense. I bought that day at $5.18. When I opened my brokerage account this afternoon it was $7.45! 43% in just 3 days.”

My first Disruption Investor pick is this switch company I've been telling you about. The one that should double—or better—every 2.5 years.

You'll find the stock name and ticker inside your free report, The Next Cisco: Double Your Money Every 2.5 Years as History Repeats Itself.

Then, as I uncover more disruptors, at least one a month, I'll add them to the portfolio.

The idea behind these disruptors is to hold them long-term to build lasting wealth.

But in the unlikely event something happens and we need to sell a stock and lock in our gains, I'll alert you right away.

Generally, though, the only time you'll sell these disruptors is when you want to move to cash for personal reasons...

Maybe to buy that new car you've always wanted. Or maybe that dream vacation.

Or maybe to help out a friend, family member, or charity.

Once we find a true disruptor, we're usually in it for the long haul.

What Kind of Disruptors

Are We Looking for?

I want to be clear about one thing. I only recommend specific kinds of stocks inside Disruption Investor .

We're looking for established companies. Not start-ups.

Generally, I'll only recommend companies that have a market cap of $3 billion or more.

Sometimes I may drop that down to $1 billion for a pick that looks like a slam dunk.

But most often they will be much bigger companies.

Why?

Because, while we're after big gains like doubling your money every 2.5 years, we want to do it safely.

But just because these are established companies doesn't mean huge, fast gains are out of the picture.

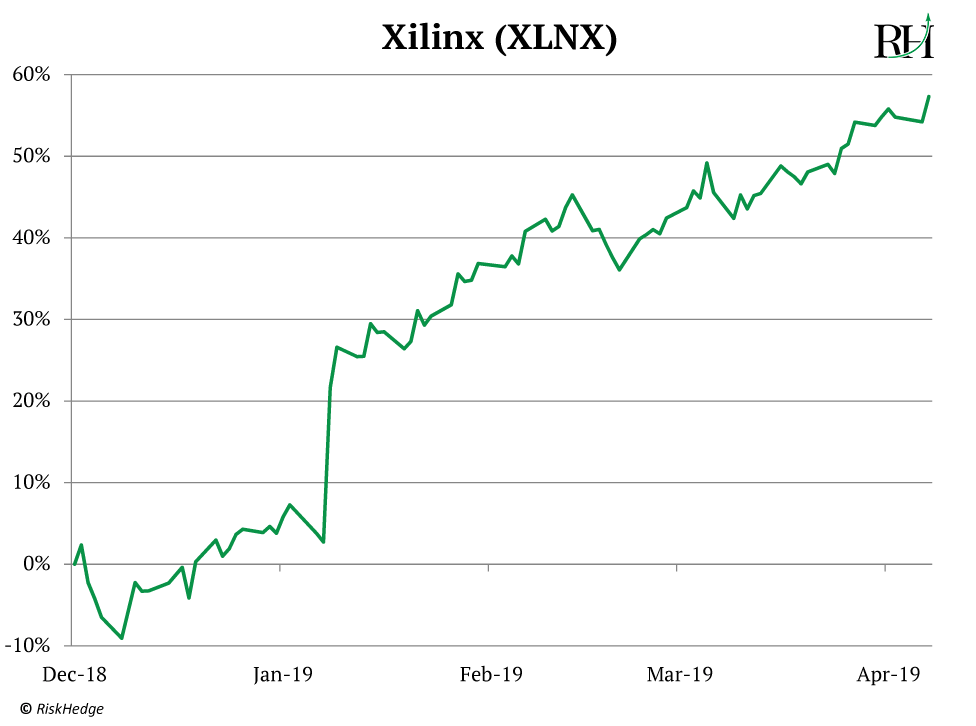

For instance, on December 6 last year, I told my readers about Xilinx, Inc. (XLNX).

Xilinx is a pioneer in 5G.

If you're like most investors, you've heard of 5G. But you might not understand how huge it really is.

5G is basically wireless phone technology.

5G is so fast that it will make remote surgery possible… It will make self-driving cars a daily reality on the roads… and it will make hologram-style video a reality too.

In short, 5G is…

The Biggest Disruptor Since the Internet

5G will disrupt just about everything.

Companies are laying the infrastructure for 5G as we speak.

But it doesn't just run on traditional cell phone towers.

Instead, it runs on special, smaller towers like these…

How these boxes are making investors in this disruptor rich. Screenshot courtesy of Sprint.

You're going to see these popping up all over the place.

They will help 5G spread everywhere.

As I said, these are already being installed in cities all across America.

And Xilinx is the company that makes the “brains” for these small cells. They create the chips that go inside.

As I said, I advised my readers on December 6 to get in…

Those who followed my lead collected a 52% profit in less than 4 months.

So, if you ever hear somebody say large stocks are too big to grow fast, don't listen.

Xilinx is a $32-billion company. And it still grew 52% in under 4 months!

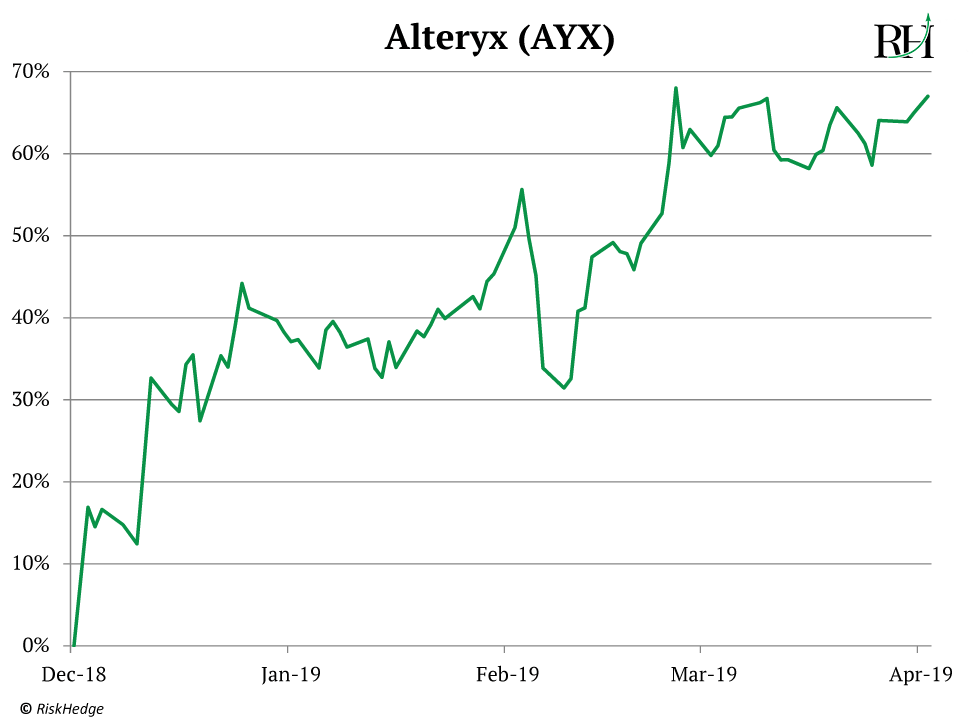

Then, just 2 weeks later, I recommended Alteryx, Inc. (AYX). Alteryx is a $5-billion data analyzer.

Alteryx is disrupting the data industry. Instead of just collecting data, they're analyzing it and even refining it.

Using new technologies, they're helping companies like Southwest Airlines turn more customers into frequent fliers.

And it's paying off...

Investors who followed my lead saw a 98.3% gain in just 19 weeks.

Let's say you invested $10,000 into Alteryx when I made the call.

You'd have earned more than $500 a week on your money. More than most part-time jobs pay.

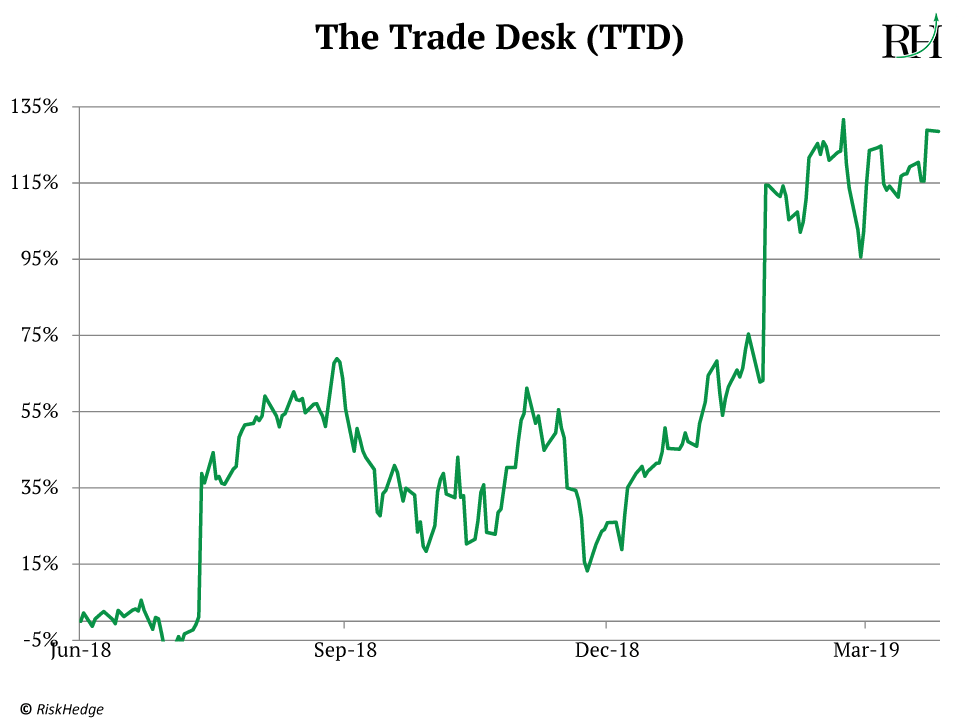

Finally, there's The Trade Desk Inc. (TTD).

I first recommended The Trade Desk to my readers on June 29, 2018.

This company is disrupting the online advertising space. And it's eating Google and Facebook's lunch.

That's how it made 123.51% in just 8 months!

And just like Xilinx and Alteryx, The Trade Desk is no penny stock. It's an $8.8-billion company.

So, when you invest in disruptors, safe, big, fast gains are possible.

Speaking of safety…

As I mentioned, I'm going to send you your free report, The Next Cisco, when you take me up on a 30-day, risk-free test drive of Disruption Investor.

Here's How Your Test Drive Works

Disruption Investor sells for $199 per year. And it's a bargain at that.

After all, just one pick like this network switch company could easily be worth 10s of thousands of dollars to you.

But since we're just launching Disruption Investor, you won't pay anywhere near that much.

Instead, I'm inviting you to be a Founding Subscriber, which means you're entitled to the deeply discounted Founder’s rate of just $49 per year.

That's a 75% discount. And it's much less than you'd pay for a good dinner out in most cities in America.

That small investment gets you a full 12 months of disruptive investing research.

And even though I'm giving you this special 75% off, I want to give you more…

Free Report #1

The Battle Over Your Fridge:

The Surprising Disruptor in the Coming $1.5-Trillion Grocery Wars

$79

$79

When I first read the stats about online grocery shopping, I was floored.

You likely know that the online retail shopping market is massive.

The grocery market is 3X larger than all of retail!

And only 2% of grocery shopping is done online.

That means that up to $823 billion dollars' worth of grocery shopping is ripe to move online.

My research shows that up to $300 billion a year will move online by 2024.

The question is… who will benefit from all that business?

Chances are, it won't be Amazon. It's already tried and failed.

More important, as you'll see in my research when you get the report, they're just not set up to do it properly.

But one surprising company is.

And in your free bonus report, The Battle Over Your Fridge, I'll reveal the name and ticker symbol of this company. I'll show you how it's set to soar by 265% over the next 5 years.

Here's a hint…

Just like the other disruptors I've been talking about, this soon-to-be-online grocery king is NOT a start-up.

It's a well-established, safe company.

One that's found a new way to disrupt the status quo.

I'll tell you exactly who it is, when to buy it, and when to sell it for maximum profit.

I'd also like to send you another FREE gift...

Free Report #2

The Mother of All Disruptors:

The $12.5-Trillion Opportunity Inside the 4th Industrial Revolution

$79

$79

I’m sure you've heard of the Industrial Revolution.

You probably know that the invention of the steam engine was what powered it.

Before the steam engine, machinery was powered mostly by flowing water. So, factories had to be built near rivers, lakes, or oceans.

But once the steam engine was invented, factories were able to spread out across America. As a result, railroads were built all across the country.

It was this single invention—the steam engine—that allowed the country to grow by leaps and bounds.

But did you know there have actually been 3 Industrial Revolutions?

That's right …

- Industrial Revolution #1 was powered by the steam engine.

- Industrial Revolution #2 was powered by the assembly line.

- Industrial Revolution #3 was powered by the computer and automation.

Each of those inventions changed the world.

And they minted new millionaire investors in the process.

Now, we are on the verge of a fourth Industrial Revolution.

And this fourth Industrial Revolution promises to be bigger than the first 3 combined. It's a $12.5-trillion opportunity.

And as you'll see in the free report, The Mother of All Disruptors, things will change at lightning speed soon.

For instance, artificial intelligence is going to make giant leaps in the next couple of years.

I'll reveal exactly what you can expect inside your free report.

More important, I'll reveal a stock that's going to skyrocket at the onset of this 4th Industrial Revolution.

My research shows that this pick will grow by 160% over the next 3 years alone.

I'll show you all that research, plus the name and ticker symbol of the stock inside your free report: The Mother of All Disruptors.

And there's one last free gift I want to send you today…

Free Report #3

The Disruption Investor Owner's Manual

How to Spot and Profit from the Biggest Disruptive Trends Yet to Come

$79

$79

You've likely heard the old saying that it's better to teach a man to fish than to give him a fish.

It's the same principle here. Except I'm doing both.

I'm giving you three moneymaking picks:

The next Cisco, the winner in the battle over your fridge, and the winner in the 4th Industrial Revolution.

They all have the power to 2X, 3X, or even 5X your money in the very near future.

But I also want to teach you to fish so you can share with your family and friends how to find disruptors too.

I'll show you exactly how to spot which stocks are true disruptors and which are really bombs in disguise.

You'll discover my 5-step criteria for evaluating a potential disruptor so you can use it in your own research.

With The Disruption Owner's Manual, you and your loved ones need never “go hungry” again.

You get these 3 reports free when you take me up on my offer to test drive and become a Founding Subscriber to Disruption Investor today.

Plus, the money you invest in a Disruption Investor subscription is not at risk.

That's because, as I said, this is a test drive.

When you subscribe to Disruption Investor today, you'll have a full 30 days to review the service.

You'll get the monthly newsletter issues. You'll get the buy alerts.

You'll get the special report, The Next Cisco, which reveals the networking switch company set to double every 2.5 years.

You'll get the special report, The Battle Over Your Fridge, that reveals my online grocery pick set to soar by 265% over the next 5 years.

And you'll get new special reports as I write them.

Review all of the material over the next 30 days.

Invest in the disruptors I share with you, if you agree with their potential.

Then, at the 30-day mark, if you decide Disruption Investor is not for you, simply let us know.

Even if you've personally profited from my research, we'll give you every penny of your money back, no questions asked.

You'll still get to keep everything we give you. And you'll still get to profit from the disruptors I share with you, too.

Also, if you join as a Founding Subscriber to Disruption Investor today, you'll be grandfathered in at that discounted price of just $49 a year.

And no matter how much others pay down the road, you'll always keep that same low price.

So, as you can see, you've got nothing to lose.

Yet, when you invest in disruptors, as I've shown you, you have everything to gain.

That's because, as good as it is, I consider this first disruptor a baseball ‘double.'

I've no doubt I'll find a triple, a homer, and a grand slam over the next year.

Click here to become a Founding Subscriber

to Disruption Investor

BE WARNED: This 75% Discount Shuts Down for Good on Thursday May 23rd!

As I mentioned, I'm offering you a deep 75% discount to test-drive becoming a Founding Disruption Investor Subscriber today.

That's a savings of $150, enough to pay for a nice dinner out in most areas of the country.

But the offer is only good until Thursday May 23rd.

After that, we have no plans to offer it at such a steep discount ever again.

On May 24th, the price will shoot back up to the regular retail price of $199. And you'll lose your shot at the $150 savings.

Why?

Because this discounted price was always meant to be temporary.

I want to build long-term relationships with all my Founding Subscribers.

And the best way for me to do that is to keep the number of Founding Subscribers small.

This discount is simply to help convince you to join me today.

Because today is when the biggest gains on the network switch company are on the table.

A month from now, who knows how much the stock will have shot up.

I don't want you to wait and miss out on profits that should be yours.

So, if you want to take advantage of this giant 75% discount and become a Founding Subscriber today, please don't delay.

This is not a marketing tactic. The price of Disruption Investor will simply never be this low again.

What Happens Now

I've told you about everything I can.

You understand the moneymaking power of toll booths.

And you understand the even bigger power of disruption.

Now, you've got a decision to make.

You could close this page out and move on with your day.

You'll probably forget about my deeply discounted offer to try Disruption Investor today.

And you'll almost certainly forget about the networking switch company I've been telling you about, the next Cisco.

You'll forget about that company, that is, until one day, you see it in the news.

And when you see the company in the news, they'll be talking about what a great investment it was.

Just like they talk about Cisco, Netflix, Priceline, and other disruptors today.

At that point, you'll know you've missed out.

Which is exactly what I don't want to happen to you.

Or, you could choose the better path today.

And that's to test drive Disruption Investor.

Just minutes from now, you'll be reading your free special report, The Next Cisco: Double Your Money Every 2.5 Years as History Repeats Itself.

Inside that report, you find the name and ticker symbol of the switch company I've been talking about.

And if you decide you want to, you can invest right away.

Then, when you hear the name of the company in the news down the road, you'll have a very different feeling.

You'll smile knowing you didn't miss out on this one.

And if we double our money every 2.5 years, like my research shows... we'll be smiling together.

When you consider the low investment in Disruption Investor and the 30-day 100%-money-back refund policy, I think your choice is pretty clear…

Become a Founding Subscriber to Disruption Investor today at the discounted price…

Click here to become a Founding Subscriber

to Disruption Investor

Looking forward to getting to know you,

|

|

Stephen McBride

Chief Analyst, RiskHedge |

P.S. As you can see from my research, this company stands a great chance of doubling—or better—every 2.5 years. That's why I'm excited to share the name and ticker symbol with you today.