I'll admit... I used to struggle with investing.

Now I make only 2 trades a month, on average.

And enjoy returns that beat 98% of investors... including most professional money managers.

All I do is run a simple set of calculations on the first day of each month...

Then make a few easy adjustments to my online brokerage account.

Although very few investors understand this method of investing...

It's the simplest, easiest, and quickest-to-get-started way to earn market returns or better with your core portfolio I've ever found.

And believe me, as a CPA and the head of an investment research company, I've looked.

Best of all, when you follow this investment method you can sail through highly uncertain markets like today.

-

It would have saved you from the 2000, 2008, and 2022 market crashes.

-

It has crushed the S&P 500, the 60% stock/40% bond portfolio, and pretty much every other benchmark since 1973.

-

It's as simple as "buy and hold," but produces larger and more consistent returns while virtually eliminating investment stress and anxiety.

If you've ever bought a stock, you can invest this way starting today.

But let me be clear up front: This way of investing is not for everyone.

It will only work if you have discipline.

You'll see what I mean in a second.

First, let me prove how effective this way of investing is.

This little-known way of investing produced 302% returns in the worst markets of our lifetimes.

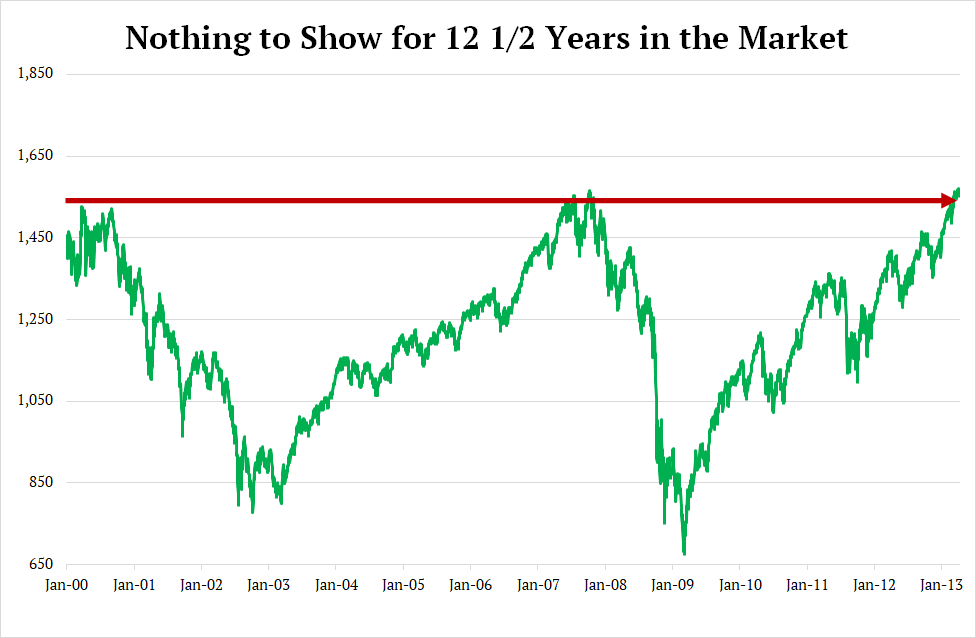

The period from 2000–2013 was the worst decade for investors since the Great Depression.

Stocks crashed twice.

First the dot-com crash, then the great financial crash of 2008.

During that 12½ year period, the US stock market produced zero returns.

When you factor in inflation, returns were NEGATIVE 25%.

Imagine your investments losing money for the next 12½ years.

Could you weather that?

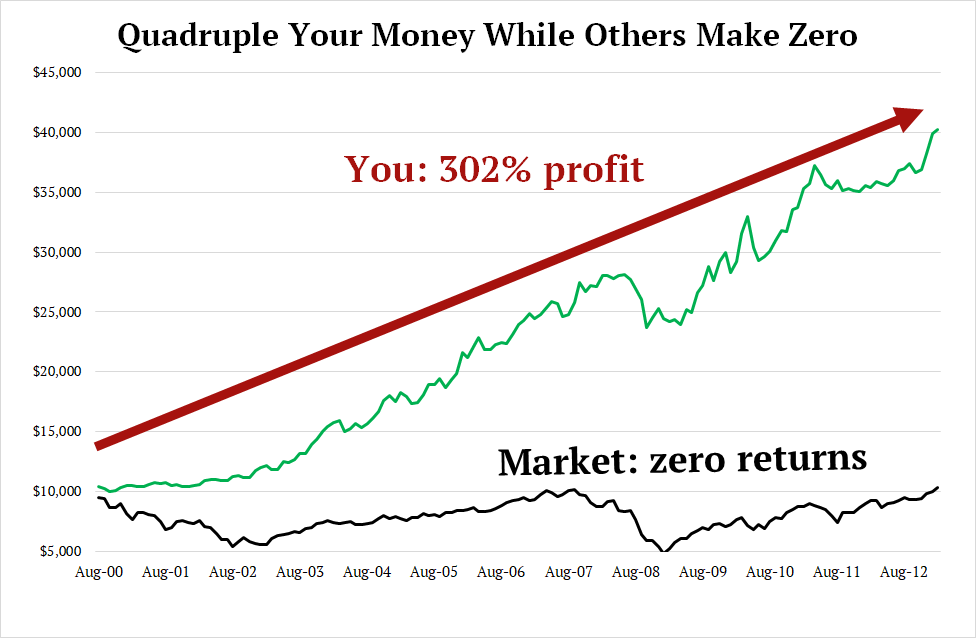

But if you had invested the way I'll show you, you would've quadrupled your money during that time instead.

While most made zero... you would've collected 302% returns:

All you had to do was make 2 simple trades a month, on average.

I'm sure you have questions... and I hope you're skeptical. I sure was when I first found this way of investing.

So instead of a long-winded explanation, let me answer the 9 questions you're probably thinking:

Q1: Who are you and why should I trust you?

Dan Steinhart

Dan Steinhart

My name is Dan Steinhart. I'm a Certified Public Accountant. I've audited Blackrock, the largest investment firm on Earth, and I'm co-founder of boutique investment research firm RiskHedge. We have readers in more than 30 countries and counting.

I'm no "guru," and I don't pretend to be God's gift to investing. I simply found and optimized a system that fits my financial goal of safely earning market-beating returns over the long haul. Now I share it with a community of 1,000+ investors.

Q2: Are you implying I can make big returns without taking big risks?

I'm not implying. I'm telling you, point blank, that this simple system produces higher returns with lower risk than traditional investing methods.

Specifically, it triples the returns of the average investor while reducing risk below that of the cookie-cutter "buy and hold" advice preached by most financial advisors.

Wall Street has tricked everyone into believing that individual investors need their sage guidance in order to have any chance at beating the market. Providing "expertise" is how they make the payments on their Mercedes.

How's that going? According to S&P Global, 94% of investment pros failed to beat the market in the last 20 years.

And don't get me started on fees. You'll pay a financial advisor 1% of your portfolio a year, on average.

That siphons off an outrageous $100,000+ from an average-sized portfolio over time. And the fee grows as your portfolio grows.

This system is completely different. The fees are barely a rounding error. And they actually shrink as your portfolio grows.

That's because there's no complexity. No hype. No stock picking.

It simply tells you the 2 trades to make a month to stay on the right side of markets. 50 years of data show if you can do these 2 simple steps, you can easily beat the market (and most of Wall Street).

Of course, I would not dream of asking you to accept that statement on faith. Read on for the proof.

Q3: How did you create this system?

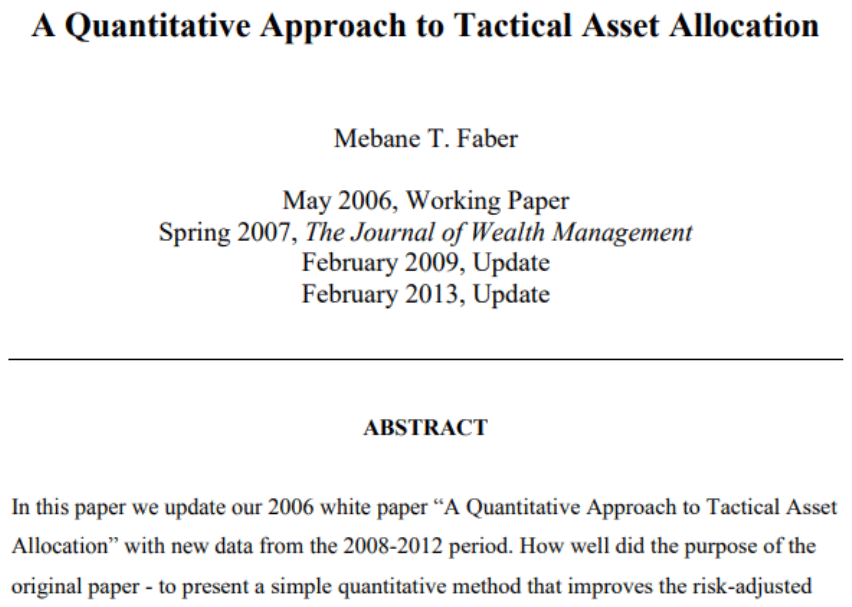

While I have worked to refine this system, all the credit goes to highly respected "quant" and money manager Meb Faber.

In 2014, I read a research paper written by Meb that blew away everything I thought I knew about investing.

In it, Meb presented an astounding result, backed by indisputable data:

By following a simple investing system, you could have made, on average, an 18% annual return through bull markets, bear markets, and everything in between since 1973.

Almost anyone can retire rich on that kind of outperformance.

Even if you only save and invest a meager $1,000 a year for 40 years, those returns let you retire with $4.9 million.

But Meb's study had one limitation. It was conducted on datasets typically only available to professional investors.

My contribution is bringing Meb's system into the real world so busy people who don't have the time, skills, or interest in navigating complex markets can easily use it in 5 minutes a month.

Most importantly, I identified low-cost ETFs that can mirror the findings of his study. I began a live test using my own assets in 2015.

Even after applying conservative assumptions, I found this method outperforms most professional money managers by a wide margin.

And it demolished the S&P 500, no small feat.

Over the past 20 years, the S&P has risen around 330%.

This method is up about 570%.

Today, I use this method to manage my family's core portfolio.

When I talked to Meb and told him I was doing this, he gave me an important insight. I'll share that insight with you in a moment.

Q4: Tell me how this system actually works.

It's a dynamic asset allocation system.

Don't worry, it's easy to understand.

"Asset allocation" simply refers to how much of different types of investments you own.

60% stocks/40% bonds is the most well-known asset allocation. But it's "static." It never changes.

Dynamic asset allocation is different. It shifts when market conditions change to take advantage of new opportunities and to protect you from crashes.

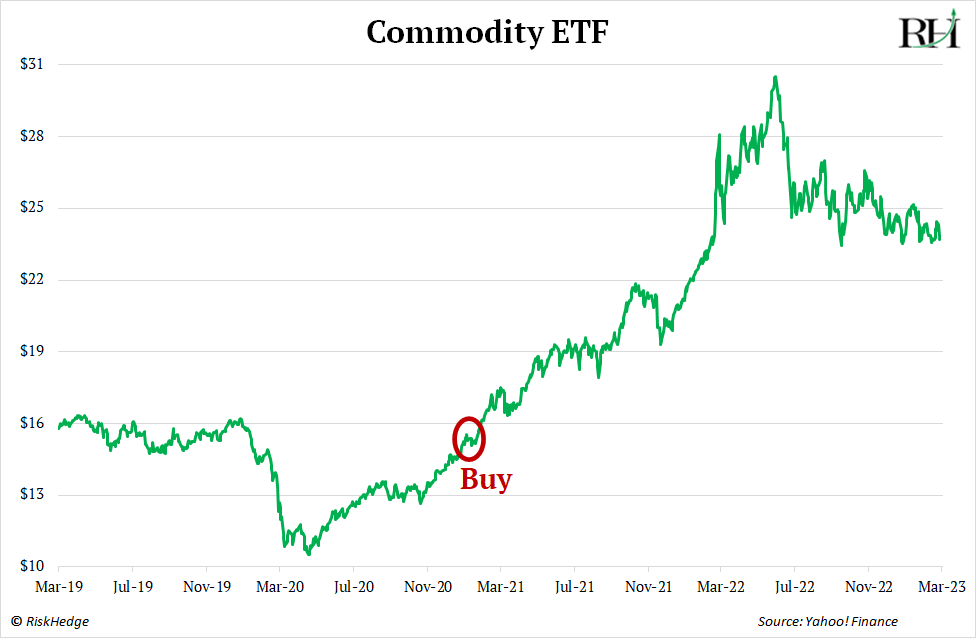

For example, in January 2021, the system issued a simple instruction.

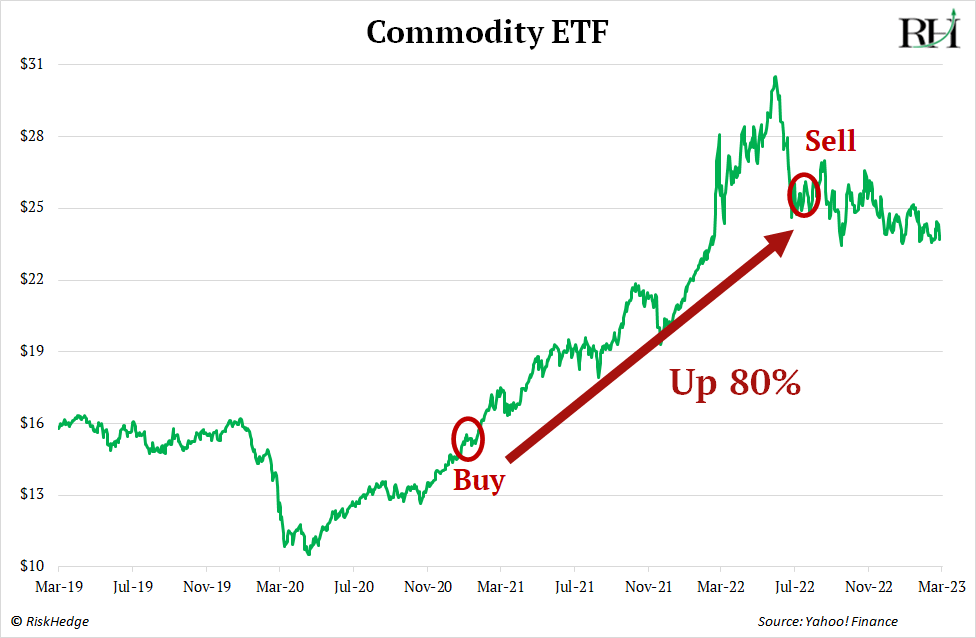

Put 1/6 of your capital into an easy-to-buy ETF that tracks the price of commodities:

I probably don't have to remind you commodity prices soared in 2022.

In fact, commodities were pretty much the only profitable asset in a disastrous year that saw stocks and bonds plunge together for the first time since 2008.

The system then said to sell commodities in late 2022, locking in an 80% gain.

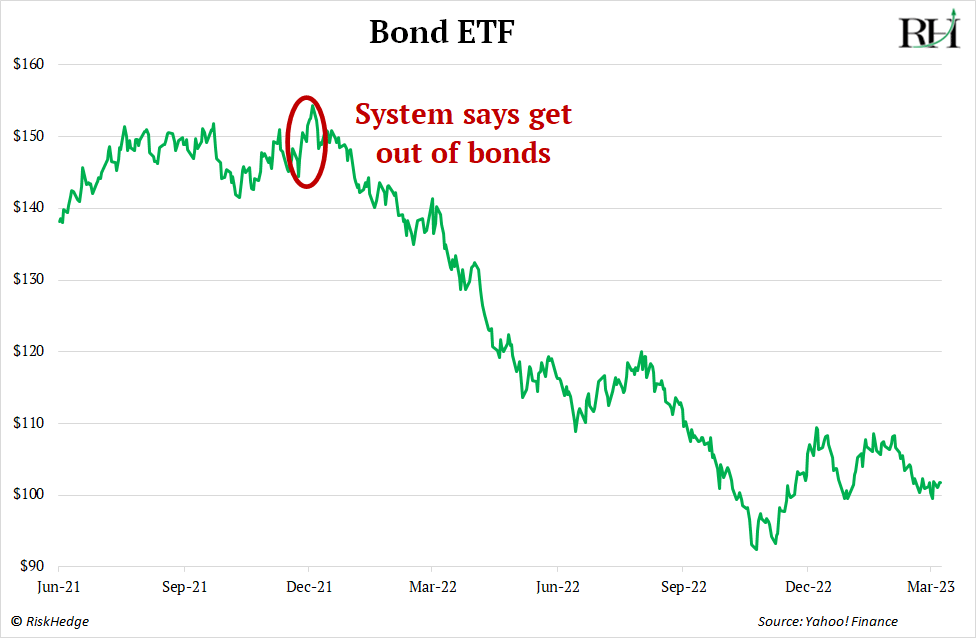

At the same time, the system said, "DON'T TOUCH BONDS" for all of 2022.

That one instruction was worth tens of thousands of dollars to even a modest-sized portfolio. Because bonds suffered their worst year ever, according to Bank of America, losing over $10 trillion in value.

The followers of this system didn't lose a dime in bonds.

The system also rotated out of stocks in early 2022.

That, in a nutshell, is how it crushed the market in 2022.

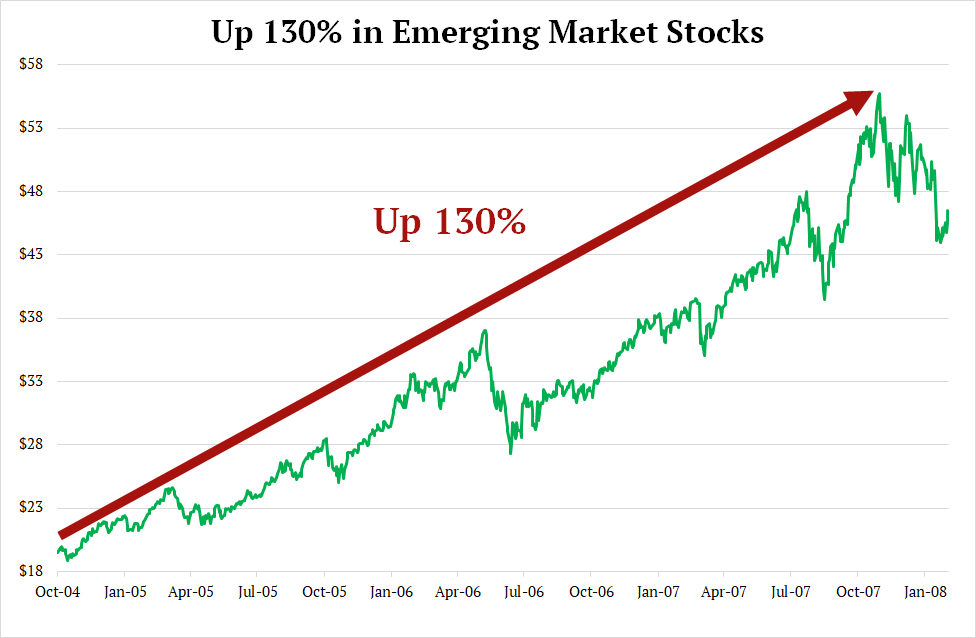

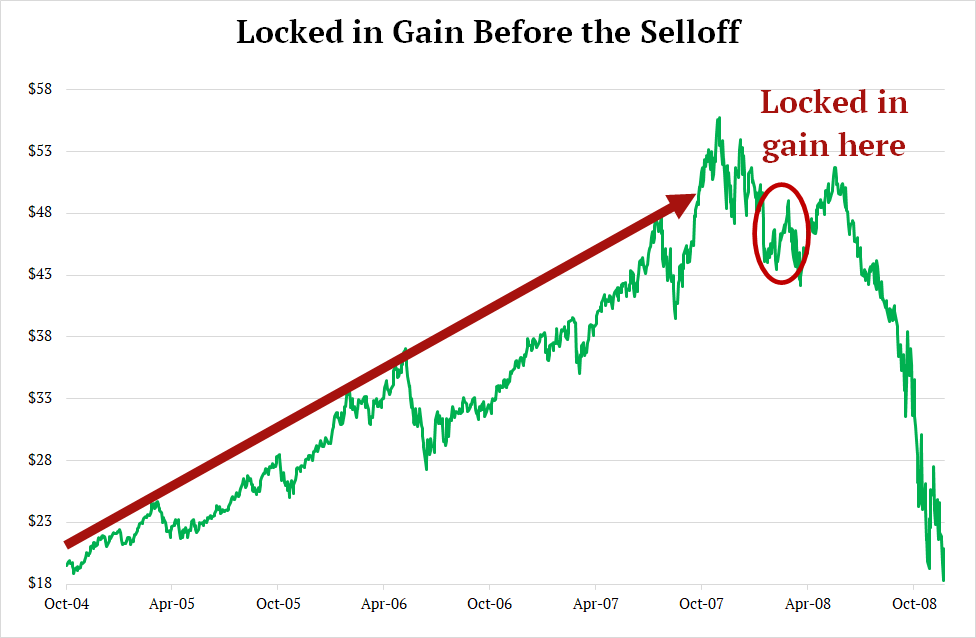

Going back further... you may remember the emerging markets mega-boom of the mid-2000s.

This system would have instructed you to allocate 1/6 of your capital to a simple, US-based emerging market stock ETF around October 2004.

You'd have enjoyed a gain of roughly 130% as emerging market stocks soared.

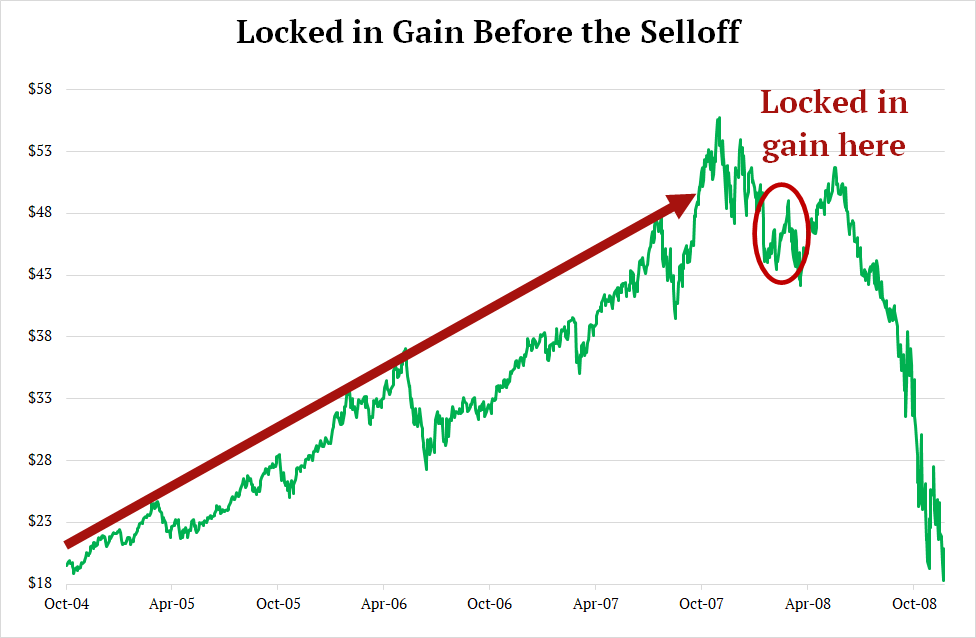

Then, the system did exactly what it's designed to do.

It signaled the time had arrived to sell your emerging market ETF in early 2008... to lock in your gain and avoid a 60% pullback.

That's a couple clicks in your online brokerage account to collect a timely 130% profit...

And another couple clicks to exit your position and lock in your gains before the downturn.

It is literally that easy.

Q5: How does the system know a crash is coming?

It uses a time-tested circuit breaker.

Simply put: The circuit breaker alerts you to EXIT a sector when it's behaving in a way that has signaled pending crashes in the past.

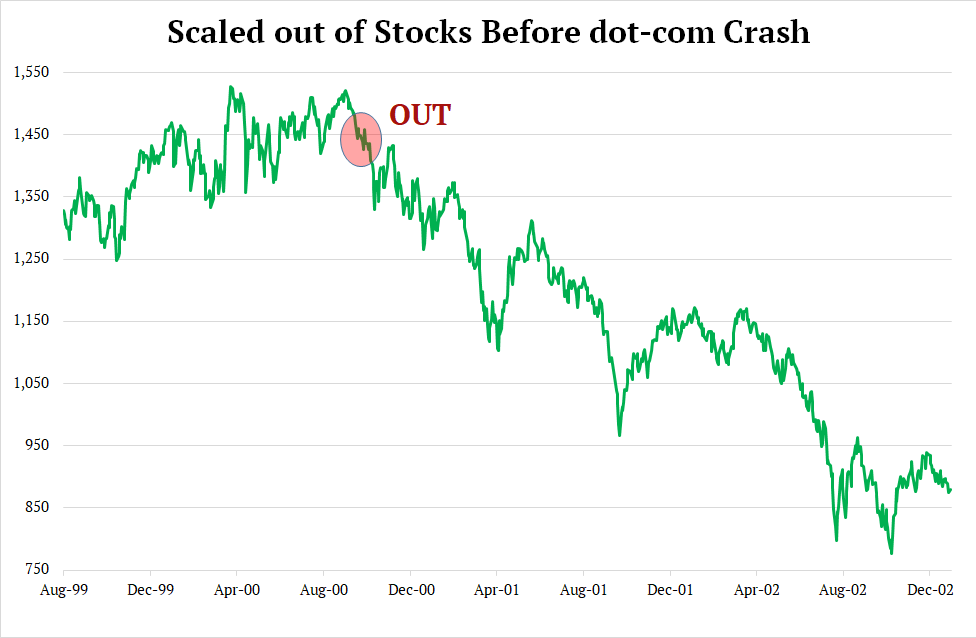

Thanks to the circuit breaker, the system scaled out of stocks ahead of the dot-com crash:

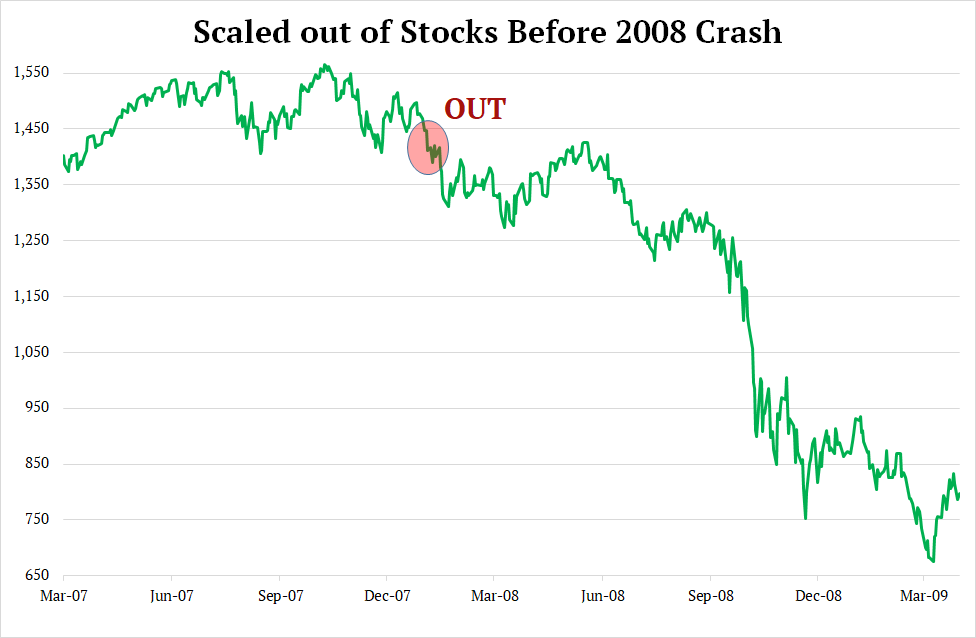

And it would've gotten you out of stocks ahead of the 2008 crash:

And the system exited bonds in December 2021, completely sidestepping the 2022 bond crash... the worst in 100 years:

I know, I know... you've been told "timing" the market consistently is impossible.

The truth is, when you eliminate human emotion and instead follow systematic rules with a 50+-year track record of nailing major market turning points... timing the market in the way I'm showing you is easy.

And no... the circuit breaker isn't some magical, secret "black box" tool.

It's based on a simple "moving average," mathematically tweaked to the right level of sensitivity.

Q6: You're making some big claims. Do you put your money where your mouth is?

I systematically invest roughly half my family's retirement accounts this way.

This method is the cornerstone of my portfolio (and I call the group of investors who follow it the "Cornerstone Club") for 2 reasons:

Reason #1: Call me crazy, but I STRESS OUT when I'm losing money.

The US stock market crashes from time to time.

Some folks can act carefree and happy when markets are crashing and 40% of their life savings are vanishing.

I prefer to avoid that situation in the first place.

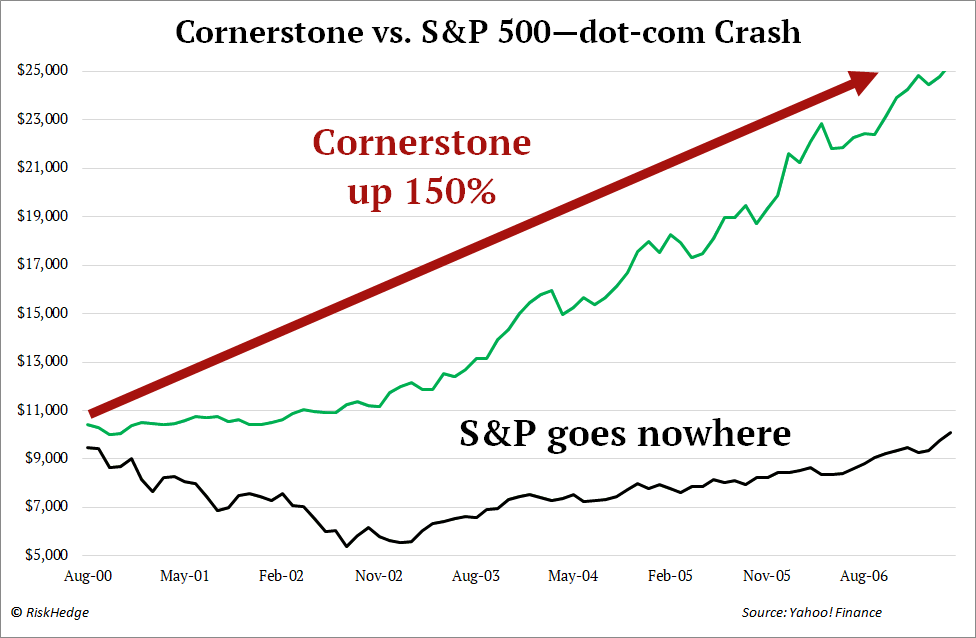

To see what I mean, look at how Cornerstone performed during the popping of the dot-com bubble.

The S&P crashed as much as 45%.

If you had $10,000 in the S&P in August 2000... it shrank to $5,500.

It took 7 long years to finally recover back to $10,000.

Cornerstone NEVER went into the red on a monthly basis during this period.

In fact, if you had invested $10,000 according to the simple rules of Cornerstone, it grew to $25,000 by May 2007.

Look at the return of Cornerstone (in green) vs. the S&P 500 (in black).

Summing up the S&P's performance in the three years of the dot-com crash:

-

2000: lost 9%

-

2001: lost 12%

-

2002: lost 22%

Now here's Cornerstone:

-

2000: gained 1.6%

-

2001: gained 0.4%

-

2002: gained 12.5%

3 years of losses vs. 3 years of gains.

Modest gains, sure... but I'll take modest gains over big losses every time.

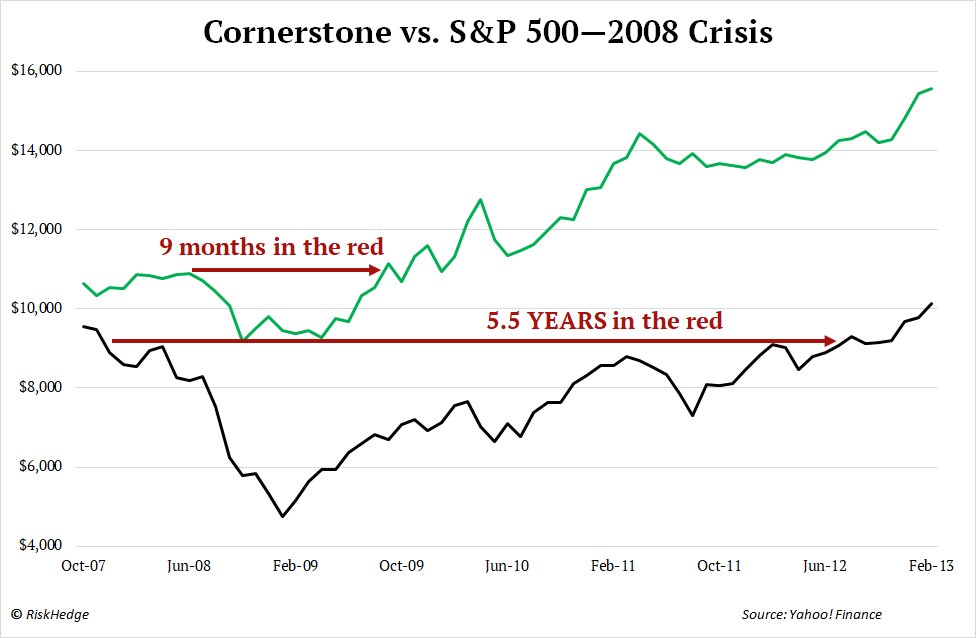

Now, look at 2008.

The S&P crashed as much as 57%.

It didn't fully recover until October 2013... 5½ years later.

As you can see here, Cornerstone fully recovered its small losses in just 9 months before powering ahead and never looking back.

In calendar year 2008, the S&P plunged 37%.

Cornerstone lost just 7.1%.

It made all its money back and was generating large returns by July 2009.

Which brings me to the insight Meb Faber (the guy who deserves all the credit for this idea) gave me.

We were discussing how this system saves you from crashes, and he said:

"Dan... the most underrated part of this method is that it tells you when to BUY. It tells you when to get back in after crashes."

As you just saw, Cornerstone would've saved you from 2008.

But the aftermath of 2008 was a time of great opportunity.

Imagine buying stocks near the bottom in 2009. You'd have multiplied your money by 5 times.

But most investors were too shell-shocked to act.

By July 2009, Cornerstone had found new bull markets and was enjoying record profits.

Meanwhile... most investors I've talked to didn't get back into stocks until 2014... 2015... 2016... or even later.

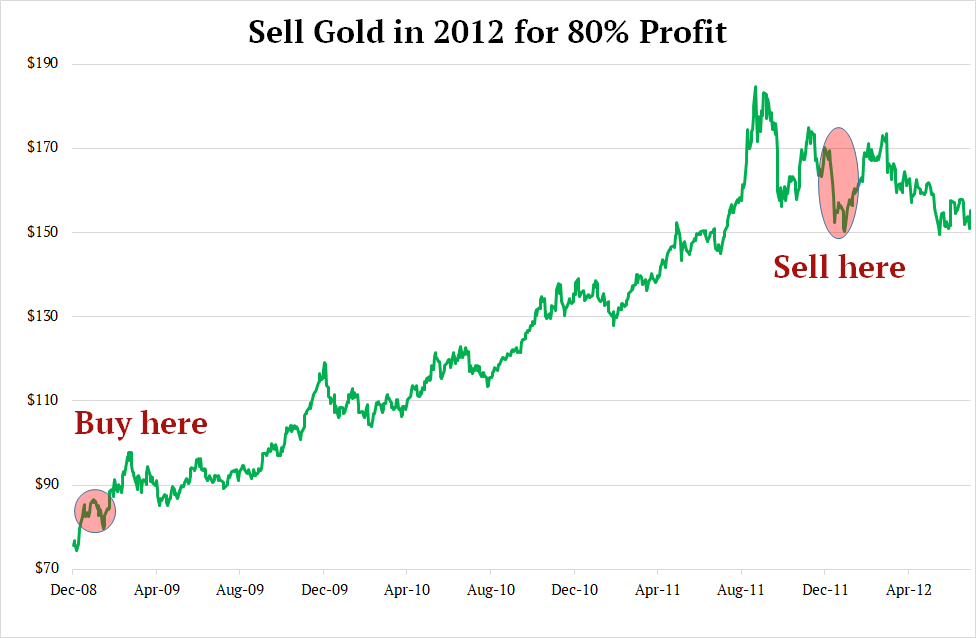

That's a shame because there was a lot of money to be made. And not just in stocks. For example, Cornerstone rotated into gold as it began to soar off its 2009 bottom.

Cornerstone would've instructed you to allocate 1/6 of your capital into the gold ETF, GLD, in January 2009.

You would've ridden the 3-year gold bull market.

Then exited for an 80%+ gain when it lost steam.

Reason #2: This method is the cornerstone of my portfolio:

I'm busy as hell.

I hate to admit it, but I often neglect my own investments.

I take care of my family and my business, first and second. Then if there's time left over, I'll pay attention to my own money.

I need a precise and time-tested method I can count on to keep me on the right side of the markets no matter what.

What other investing method allows you to all but neglect your money and still outperform 98% of investors?

Q7: You keep saying "allocate 1/6 of your capital." Explain in plain English.

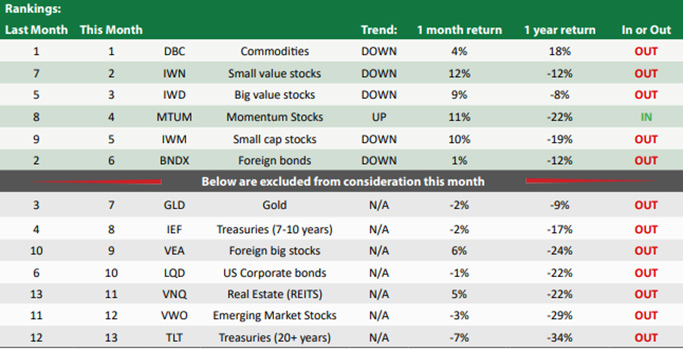

Cornerstone calls for splitting your portfolio into 6 equal parts. Those 6 parts are divided between some combination of 13 different market sectors.

Each month, if the system signals a portfolio change, you might sell 1/6th in a sector which is beginning to falter, then reinvest in another sector that's moving upwards.

The 13 sectors cover the 4 major global asset classes—stocks, bonds, commodities (including gold), and real estate.

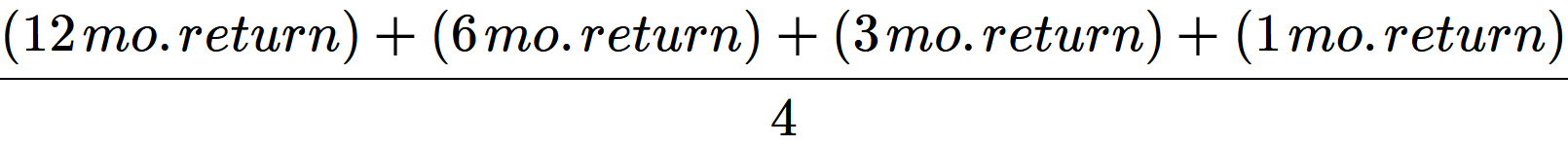

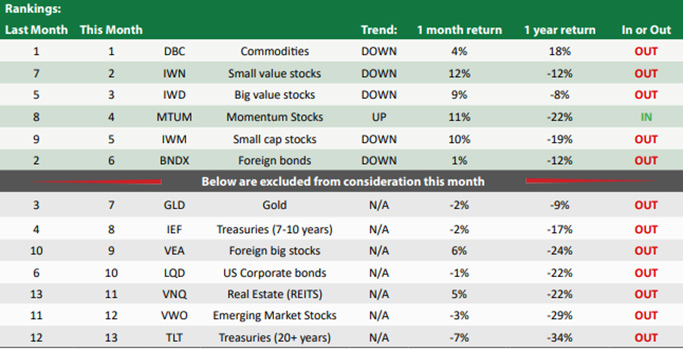

Each month, I run this simple mathematical formula to rank the 13 sectors:

The result is this ranking table:

The 13 ETFs you see represent the "world" of investments available to you and me and everyone else.

We discard the bottom 7.

Then invest 1/6 of our capital into each of the top 6.

But only if their circuit breakers have not been tripped.

When Cornerstone is signaling "all clear," you'll be 5/6 or 6/6 invested.

When the markets are struggling and the rules-based methodology indicates the time has come to sell, you'll be instructed to move into safer assets... like in 2000, 2008, and 2022.

And you'll never be overexposed—because you'll never have more than 1/6 of your capital in any one sector.

And you'll never have to worry about whether you should be "all in" or "all out" of markets...

Because Cornerstone scales you in and out of 1/6 of your portfolio at a time—according to rules with a 50-year track record of beating the market.

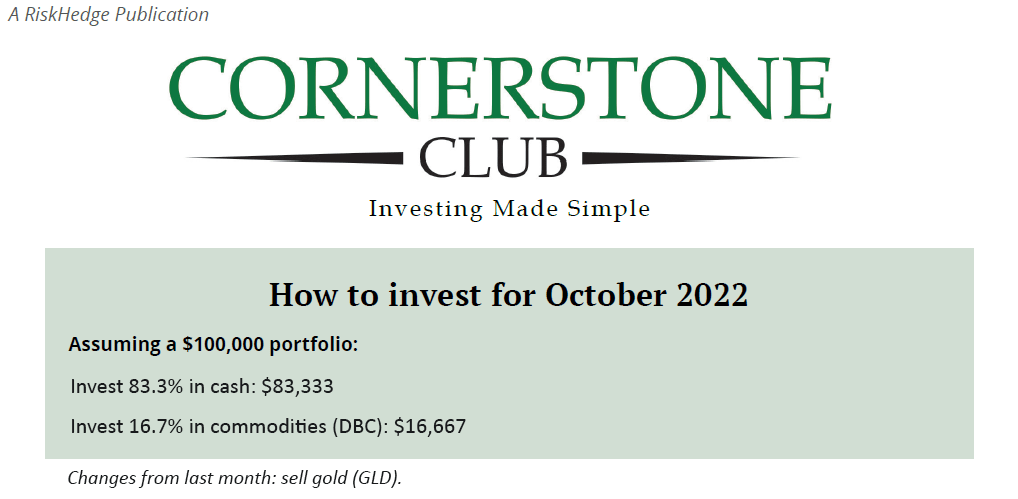

Don't worry if this sounds complicated. At the top of every monthly research report is a simple summary of actions to take. It looks like this:

It's so easy to follow, it should literally take you no more than 5 minutes a month to stay on the right side of markets.

Q8: Is Cornerstone right for me?

Only you can decide.

As you've seen, Cornerstone is backed by a 50-year track record of crushing the market.

But it only works when you have the discipline to stick with it.

Sadly... a lot of investors' critical thinking abilities have been degraded by our instant gratification culture.

These poor folks chase meme stocks, penny stocks, or whatever "hot" thing will give them their next dopamine hit.

Cornerstone can't help them.

You don't need much to profit from Cornerstone.

A $5,000 portfolio is plenty. All it takes is 5 minutes a month.

And you don't need any investing knowledge.

But you do need the character and discipline to stick with the plan.

Cornerstone will not beat the market every individual month. It is designed to beat the market over longer periods by rotating into sectors that are rising, and warning you to stay out of sectors that are stagnant or falling.

Lastly...

What if you enjoy shooting for 1,000%+ gains in tiny stocks, options, and other high-upside but risky strategies?

You'll be right at home in Cornerstone Club.

My suggestion is to allocate part of your core portfolio to the safe, long-term oriented strategy offered by Cornerstone.

Then, knowing most of your money is safely earning high returns and protected from market crashes...

You're free to take a small slice of your portfolio to go for "moonshots."

Q9: Okay, how do I get started?

Every month, we run the calculations and I send the simple trade instructions to members of Cornerstone Club.

The trades arrive in a crisp email report. Anyone can use it to adjust their portfolio to stay on the right side of markets in 5 minutes a month.

Given the results I've shown you, backed by a 50-year track record of beating the market and avoiding crashes... you're probably thinking membership costs an arm and a leg.

But unlike the money you'd pay a typical financial advisor... being in Cornerstone Club won't cost you $100,000+.

It doesn't cost $5,000... or even $1,000.

Although the results justify that kind of price tag... charging that much would defeat the purpose of what I'm trying to achieve with Cornerstone.

As I've shown you again and again... simplicity always wins in investing.

That's why our motto in Cornerstone Club comes from Leonardo da Vinci:

Simplicity Is the Ultimate Sophistication

In investing, simplicity means keeping your fees as low as possible.

That's why Cornerstone Club costs $19.95 a month.

No broker fees, no management fees, no performance fees... nothing.

When you join, you'll pay $19.95 a month for as long as you choose to remain a member.

Due to inflation, we'll have to raise the price for new subscribers in the future.

But we'll never raise the price on you once you're in.

It works out to $0.66 a day... and that's all you'll ever pay.

You can cancel at any time, and you are never obligated beyond the current month you have paid for.

What You Get with Your Cornerstone Club Membership Today

At the beginning of each month, I'll send you a new report with that month's allocation instructions.

Simply make the one or two recommended trades... and that's it.

Each monthly report includes our proprietary rankings table:

It shows how the 13 sectors stack up... so you'll know which are strong and which are "stayaways."

I also include a brief commentary on the trends in each sector... as well as a few key charts that will help you better understand the big picture.

If a sector is approaching buy status, we'll let you know early so you're prepared to act as soon as it's triggered.

Here's everything you get as a Cornerstone Club Member:

-

Monthly Cornerstone Club allocation instructions—sent right to your email by the third business day of each month. Simply read it and then make the one or two simple recommended moves.

-

Cornerstone Primer—A 33-page "Owner's Manual" on the Cornerstone methodology, how it works, and how it can protect and secure your wealth.

-

RiskHedge Members-Only Website Access and Archives—You'll get a unique login and password so you can read every alert starting today.

-

Dedicated phone concierge—If you have questions about your Cornerstone membership, anything you received, your login credentials—anything—you can reach our customer service team via phone at (844) 848-8835 (+1-602-883-1999 if calling internationally) between 7 a.m. and 4 p.m. MST (Arizona), or email anytime, day or night.

Bottom line, I'm trying to get Cornerstone Club in the right hands.

Because you've read this far, you're probably the right type of person.

As long as you have the discipline to follow the rules, being in Cornerstone Club will make you richer.

When you join now, you'll get instant access to this month's allocation instructions.

Simply do what they say. It takes no more than 5 minutes.

Then enjoy being on the right side of markets... backed by a 50-year track record.

Click the button below to get started.

You'll be directed to the checkout page, where you can review all the details of what you get inside Cornerstone Club.

Click to Secure My Spot Inside Cornerstone Club

Dan Steinhart

Co-Founder, RiskHedge Research

Editor, Cornerstone Club

Have more questions? I have answers:

Q: What's your refund policy?

A: No refunds. You can cancel at any time without further obligation by sending us an email that says "Cancel."

Q: Do you really ban people who subscribe and then cancel?

A: Yes. As I keep saying, Cornerstone only works if you have the discipline to stick with it.

If you subscribe and decide it's not for you, no worries. But you can't come back because I have no interest in selling research to people who won't use it as intended.

Q: Dan, I am looking at your charts, and I notice they don't sell at the exact tops or buy at the exact bottoms. What gives?

A: This isn't internet fantasyland where they dazzle you with cherry-picked data then disappoint you with the actual results.

I'm telling it like it is. Cornerstone catches the bulk of big uptrends—that meaty 80% in the middle where most of the money is made. It keeps you on the right side of markets, without needing to tick the exact top or bottom.

Q: Dan, your data is all from the past. How do you know Cornerstone will perform this well going forward?

Let me know when you figure out how to obtain data from the future :)

Seriously, no one knows anything for sure in the financial markets. But as far as I'm aware, it gets no closer than a 50-year track record of both beating the market and sailing right through crises like 2000, 2008, and 2022.

Q: I showed this to my financial advisor, and he says ________

A: This way of investing is an existential threat to your financial advisor's business model. Because the reality is this system not only has been proven to outperform the markets... but also the vast majority of investment advisors and professional money managers.

And it costs almost no money or effort to use.

Maybe, just maybe... your financial advisor is biased.

Q: Why do you lampoon financial advisors?

Because many (not all) are salesmen with a shallow knowledge of investing.

Q: This sounds too good to be true. Tell me the absolute worst thing about this system.

I'll give you two. When the US stock market is in a raging one-way bull market, Cornerstone may underperform it.

Also, it corrects course quickly... which can occasionally result in exiting a sector we recently entered. People who follow our research know to look past the occasional short-term gyration. The long-term results speak for themselves.

Q: What if I have a question after I join?

If your question is customer service related, you can call our helpful US-based team and get an answer right away.

If your question is about the strategy or the trades, you can write me directly. I'll give you my email address as soon as you join.

Cornerstone Club has well over 1,000 members, so I can't answer every question individually. But I read every email and send "FAQ updates" to answer the most common ones. You'll get access to past FAQ updates as soon as you join.

Q: What do people say who subscribe to Cornerstone?

"Color me so impressed with your subscription here that I am selling it to my clients, and several praise it too. You are perfect for the busy professional."

"Honestly, this is exactly what I was looking for..."

"This really struck a chord with me..."

Click to Secure My Spot Inside

Cornerstone Club

Copyright © 2025 RiskHedge. All rights reserved.